The Glory Days

Don Draper and his Mad Men peers were fans of the Market Research Survey. While the tv show was based in the 1960s -1970s, market research surveys were still considered cutting edge at the time. Now we have arrived at the one hundred year mark, the relevance of market research surveys are certainly on the decline.

Starting in the 1920’s, Daniel Starch created a way to gauge impact of advertising campaigns on audiences. He would approach random people on the street and ask whether they could recall specific advertisements. Although we’ve had a hundred years of technological advancements since that first market survey, this strategy has remained a staple for marketing teams all over the world.

At XY, we believe there is a better way. In fact, our company believes market research surveys are not only a poor use of time, but they also fundamentally lead to incorrect conclusions based on faulty assumptions. This is because surveys are predicated on the idea that: a) relevant people; b) are honestly answering; c) relevant questions. In our experience, this is not the case.

Who’s Completing Your Survey?

One of the core tenets of surveys is answers should reflect the views of your relevant audience. But is this correct? Financial services product providers are typically looking for decision makers who plan to stay in the industry for a long time. Or to be more specific: practice principles, in private licensees, with degrees. In other words, the type of adviser who has the authority to make a decision with longevity ahead of them. We spend a lot of time speaking with these types of advisers, and from our point of view, they are the exact personality type who avoids spending time completing surveys.

Successful and self-directed advisers are particularly concerned with the use of their time. They enjoy being left alone to focus on their own business. They don’t want to share any information beyond what’s necessary because they have data and privacy concerns. Typically (although not always) it’s advisers who are not this ideal persona completing surveys. As such, we believe market research surveys fail in their first premise of collecting results from ‘relevant people’.

Data and Privacy Concerns

This brings us to the next concept of ‘honestly answering’ survey questions. People are now acutely aware of the constant battle in avoiding data collection. Call it the ‘Cambridge Analytica’ effect, but people no longer simply provide details about themselves. The zeitgeist has shifted. In the late 2000’s we all signed up to Facebook to proudly declare our favourite quotes and movies. The goal at the time was to put as much personal data on to Facebook as possible and promote our individual place in the world. Call it naïve, but we had no idea this was all going to backfire.

The birth of ‘targeted advertising’ created an unvetted environment where those with nefarious intentions could influence us. This provided a way for third parties to bombard us with never-ending and self-serving advertising.

In hindsight, we can all see how this naivety had an impact on the world. One could argue we live in the results of this every day. But one thing is for sure, people now value their data privacy. People are far less likely to share personal data on Facebook, or answer survey questions honestly. It’s for this very reason we built a business model based on understanding problems rather than understanding personal data points.

In many ways we believe XY is the antidote to these questionable business practices. Our goal is to discover problems to solve rather than personal data points. Our revenue comes from partnering with the corporate community to create vetted, relevant, and valuable education based on the problems advisers encounter. So while our front end may feel like traditional social media, our business model is entirely different. Our existence is not predicated on the idea we know everything about individual advisers. It’s predicated on understanding advice problems at an industry level. We made this decision for many reasons. The fact people wish to actively avoid data collection being an obvious one.

Research Should be Done Prior

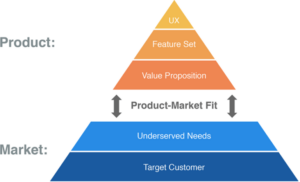

The final incorrect survey premise is the idea that ‘relevant questions’ are being asked in the first place. In our experience, the reason most surveys are requested is to solve a feedback gap in the product development lifecycle. However, this issue represents a flaw in the way most financial services products are created. Very rarely are we approached with a survey to discover the under-served needs of advisers. Most commonly we are approached with a survey to receive feedback on existing products. But the key issue here is the product has already been built. Untold millions if not billions of dollars have already been invested into a feature set and user experience. As such, the only relevant questions are slightly different versions of: a) what do you like about the product; b) what don’t you like about the product?

But relevant questions are about understanding the adviser community better.

- What problems are keeping them up at night?

- What are their major concerns?

- What slows them down?

- What do they consider a waste of their time?

These are the types of questions that should be asked. Before a single dollar is spent on the product solution, a deep understanding of the underserved needs of your ideal market is where all attention should be allocated. Most surveys are not asking the right questions, as most surveys are looking to justify an existing product rather than deeply understand adviser problems.

Artificial Intelligence

Understanding and solving adviser problems is how we align our revenue model to fit our reason for existing. Our purpose is to drive the positive evolution of financial advice. By repurposing conversational content into actionable adviser problems, we ensure the issues advisers experience are not lost into the ether. Rather, those moments of vulnerability are treated with respect and given the attention they deserve. We educate our AI with adviser problems, and work with our corporate community to explore de-identified problems at a contextually relevant level. This new ability to explore unstructured information and produce relevant insights eclipses surveys in every way.

In 2022, market research surveys are lagging in the race to better serve advisers. This one-hundred-year-old strategy has been replaced by a piece of technology few people understand, and even less can use with purpose. Solving problems to gain market share is nothing new, but financial services have traditionally been under-indexed here. To discuss how XY can help you better understand adviser problems, creating more valuable education and product solutions, please feel free to reach out to us here.